Steve Jackson Games Stakeholder Report Discussed

April 19, 2017 by crew

Regardless of how long you’ve been a gamer, you’ve likely encountered Steve Jackson Games and their products at some point. They’re probably best known for the Munchkin franchise, but also for the likes of GURPS, Car Wars, Ogre, and Zombie Dice, amongst others. Steve has also been one-half of an endless source of confusion for gamers (“no, not that Steve Jackson, the other one!”).

Although they’re not a publicly traded company, and to the best of my knowledge are wholly owned by Steve, SJG do publish what is perhaps the most comprehensive insight into the business of any gaming company in the shape of their annual stakeholder's report. This is a warts and all look over the previous year which both celebrates the achievements and highlights the issues that the company experienced.

Report Released

The 2016 report was released last week and the headline figure is the just over $6 million in gross revenue the company earned, marking both the second straight year of declining revenue and a net loss for the first time in over a decade. That said, the company is clearly bigger than it was the last time it made a loss, with almost three times the full-time staff and over twice the revenue it had then (not adjusted for inflation).

The peak year for revenue was 2013 at $8.8 million, following several years of significant growth in line with the overall growth of the tabletop industry (if not a little ahead of it). That figure does include almost $1 million raised via the Ogre Kickstarter campaign, so 2014’s figure of $8.5 million is arguably the better year financially.

Which begs the question, how did they lose almost a third of their revenue in just two years? The bulk of the decline came in 2015, for which part of the reason was the lack of any new mass channel sales partners. The existing ones maintained stock, but the company missed out on the sales bump a new partner brings.

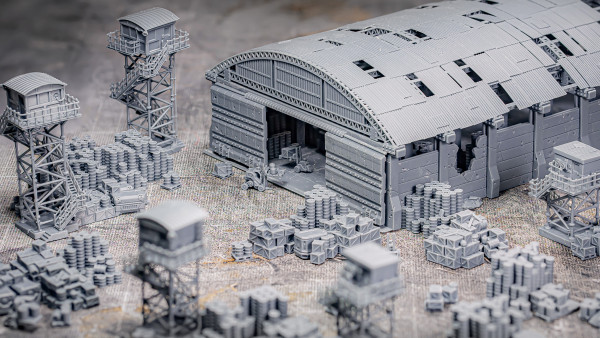

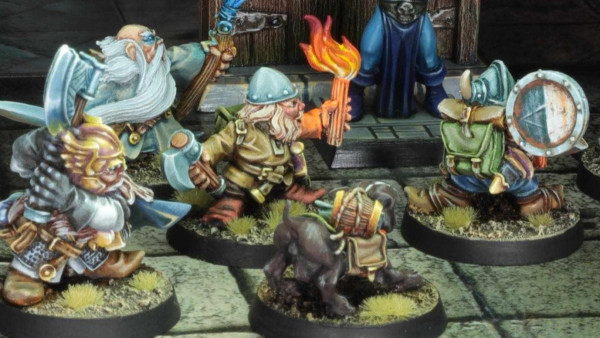

Mainly, though, the issue seems to have been in bringing products to market. Remember that near $1 million raised in 2012 for Ogre? Well, that campaign still has not completely fulfilled. Another Ogre Kickstarter campaign, this time for a set of miniatures, raised over $100,000 last year but has hit delays. (I know what you’re thinking, “A miniatures Kickstarter with delays? No way!”).

Another Kickstarter campaign for a GURPS starter set called Dungeon Fantasy has also hit delays and ballooning costs. It should have been printed by now and will almost certainly make the company a loss.

It’s not just crowdfunded projects which are proving problematic in bringing to market. The Munchkin CCG has been pushed back from its initial release date of late 2016 and is unlikely to be in stores before next year. Car Wars 6th Edition was supposed to have a Kickstarter last year in time for it to go to print before the end of the year.

That too has been delayed. This has prevented the company from bringing as many new releases to market as were planned for, which in turn has hurt sales revenue (as nothing sells like new sells).

The crowdfunded projects do bring their own additional issues with regards to completing them. Had Ogre not gone to Kickstarter, then SJG would not have to be ploughing on with trying to do the computer game version they promised as a stretch goal, but as it was promised as a stretch goal, it needs to be done as part of that project’s fulfillment, and is currently over two years late and counting.

If Dungeon Fantasy had not gone to Kickstarter, then as the costs mounted up the project could have been amended or shelved, but SJG will have to see it through even though they know it will likely make them a loss. Of course, without crowdfunding those projects may never have gotten started, to begin with.

The GURPS line is having issues as well. Print versions of the books are proving to be loss-makers, so, for now, the future of that line is in PDFs. None of this figures to get any better for this year. The report places the priorities for 2017 as continuing to work on these delayed projects, with little in the way of new projects discussed. It wouldn’t be surprising to see a further decline in revenue in next year’s report.

A Silver Lining?

It’s not all doom and gloom, though. As mentioned, the company is much bigger than it was a decade ago, and its loss-making revenue dwarfs its revenue from the last time it made a loss. If the Ogre projects, Munchkin CCG, and Dungeon Fantasy can be completed this year then that will mean lots of new product to sell, as well as clearing the way for the likes of Car Wars 6th Edition to move on.

The Munchkin Shakespeare Kickstarter campaign is on track to deliver on or close to the estimated shipping date, Zombie Dice continues to outperform expectations, and some new games were released in 2016.

The report ends with the company’s top forty selling games of 2016 by dollar amount (as opposed to unit sales). The immediate standout is that fully thirty-five games in the top forty are Munchkin titles of one form or another. The 2007 stakeholder report listed Munchkin as providing over 70% of the sales revenue, and this chart suggests that may well still be the case, if not more so.

Zombie Dice is the best-performing non-Munchkin game at number three, and Illuminati is the only other to crack the top twenty.

A Final Thought

A couple of broader points can be brought out of the report to close out this article. The first is to do with delays. A lot of us will have backed Kickstarter campaigns, and will almost certainly have experienced frustrating delays in waiting to receive our product.

As the rare insight to the inner workings of a company that the SJG stakeholder report shows, delays are common due to a myriad of unforeseen factors, even for established companies with decades of experience in bringing products to market. Most of the time we’re not aware of them, but we become hyper-aware of them when we’ve backed a Kickstarter project that is experiencing delays.

The issues GURPS is having in making print products profitable could be a harbinger of a trend towards digital. It should be said that this is only one game line and not an especially successful one. Plus it exists in the RPG market, so its challenges are not necessarily the same as those faced in the likes of miniature gaming in bringing rulebooks to market.

That said, every company who is struggling to make the costs and profit margins work for print, or who struggles to get their books into stores across Europe and North America, may well start to make the same decision.

If you would like to write an article for Beasts of War then please contact me at [email protected] for more information!

"SJG do publish what is perhaps the most comprehensive insight into the business of any gaming company in the shape of their annual stakeholder's report..."

Supported by (Turn Off)

Supported by (Turn Off)

"It’s not all doom and gloom, though. As mentioned, the company is much bigger than it was a decade ago..."

Supported by (Turn Off)

I’m a GURPS lover!

i’ve always liked the horizontal growth!

Imho instead of a kickstarter wich was almost a repackaging (i had like 90% of those issues)

they should focus on the REAL problem: GM TOOLS!

if the system is really flexible and broad and detailed and all….. it is a JUGGERNAUTH for the GM to prepare a session!

one simple thing that coul help A LOT would be a more powerful character assistant, something that could give you a monster or npc in 4-5 clicks

THAT is one of the biggest issues imho for gurps….i don’t have the time it requires to prepare a session!

Is Juggernauth a Juggernaut Behemoth?

Gurps is definitely that sort of a system, and some good NPC and monster generators would be a welcome addition to every GM.

munchkin will likely buy them the time they need, but I would have thought they would be upset about the mistakes they have made costing them the fruits of their success with it to date. the computer game sounds like a hard learnt lesson.

the thought of everything going digital is the stuff of nightmares for me. I have a thing for books and especially hard covers. having the digital copy is useful sometimes but real books is my preference .

well i have mixed feelings for digital rpgs….

i think i like having a physical copy of the most commonly used manuals and digitals for things like adventures special paths or things like that (ah if i buy the physical copy plz plz i feel i should have also the digital one for free thanks)

I do like the physical aspect of gaming, which includes nice thick books (especially if they look&feel expensive).

I don’t mind the digital variants too much provided they’re cheap and drm-free.

However given that maintaining digital shelve space isn’t free I wouldn’t mind paying for them provided there’s a discount for owning the physical version.

I’m slowly getting my head around using digital rulebook. Now I’ve notebook-sized laptop I find the search function very handy when consulting a rulebook PDF. I do still prefer reading a hardcopy. There is a potential long-term issue for a line that switches to digital, in that you lose the chance to catch the eye of potential new customers who see the books on the shelves.

True- but that’s not just a problem for gaming books. All of publishing is trying to figure out how the new “Showroom Floor” works in digital (it used to all be about getting into the major bookstore chains).

A game or any publication could see if they can reach some threshold of sales for the digital version and then put together a print run for a limited edition. It still wouldn’t solve the issue of not catching the eye of potential customers in book and game shops but it would satisfy those that want a printed book. They could also produce the digital version such that a print on demand version could be produced.

I’ll never lose my soft spot for SJG. Oh my I played a lot of Car Wars in the 80s!

I’ve supported a lot (A LOT) of kickstarters and I’m not generally concerned with delays. It happens. I’ve had kickstarters years late and some (very few) that have delivered early. It is generally rare that a kickstarter (for games and more so for miniature games) delivers on the schedule they initially start with. But the delays and issues pointed out here in this article (very good article by the way) worries me in the sense that since most games are actually manufactured by the same set of printers and factories there may be an issue with the capacity of these… Read more »

Before Chinese factories began to become a viable option for plastic miniatures, there was the notorious ‘Renedra Bottleneck’ for getting plastic minis done. I know companies that do hand-poured resin minis have experienced similar bottlenecks as it’s slow casting process and there’s only so many companies who do it. I’m not sure whether SJG have experienced with any of these projects. What stood out to me when I was going through the report was that, for example, the Munchkin CCG looks like it’ll be at least a year late. I doubt many people outside of SJG really care all that… Read more »

Interesting analysis. If this continues and we see more kickstarter issues will the rest of the market be far behind?

This company has more opportunities to sell games than many as they are in a broader retail base.

My take is that they need to diversify from a one product company. It looks like they are trying but are failing to get successful products to market. If they don’t get something going then they will have to get leaner.

SJG used to do pretty well in the RPG market because they published well-written and well-researched source books that were highly portable to other game systems and reasonably priced. After D&D3 came out and the standard for published RPG supplements shifted to glossy, high production-value hardbound books that cost 200-250% of the price of the older soft bounds, SJG spent their RPG warchest trying to relaunch GURPS with a series of hardbound system-specific core books which killed the core of their business which was selling affordable supplements to people that used them in other systems.

If you haven’t ever read a setting book by SJG do yourself a favour and read something like GURPS space!

It’s apotheosis of Nerdiness!

Everything is an aproximation of actual physics laws where is permitted!^^

Also the sci-fi is analyzed with thoughts like…. if FTL is based on warp and you can’t sense things in a different space then space battles are fought around planets and you won’t have many ships patrolling….

Or the druidic magic in gurps magic/thaumaturgy…. simply a joy for anu gm who likes things that have an internal logic